I was horrified by the contents of one of my Finnish mutual funds when I looked into it after years of disinterest: USA is overweighted, and I hate some of those companies I’ve ended up owning.

I’m especially disgusted by UnitedHealth Group Inc - the health insurance company whose mass murderer CEO got shot recently, sparking nationwide cheers.

As a passive investor, you’ll forget your money into the wrong hands when the bank won’t remind you of developments in the political situation.

Ålandsbanken promises:

“socially sustainable”

You may assume your bank is civilised, but you should have a closer look. I’m a customer of S-bank in Finland. In this case, the fund ended up under a different bank twice due to buyouts, and the management of the fund ended up in a Canadian bank branch in the UK.

My other bank didn’t recommend selling my Russian investment when Putin’s reign had started going overdue after his full term as a president. Luckily I was awake and sold everything.

Investments drift out of balance over time. Within mutual funds, there are limits, but the funds grow at different rates. You should re-balance your diversification once in a while to avoid excessive country risk.

I don’t know if fund managers are bribed to distort the balance within the fund’s limits for the benefit of a third party.

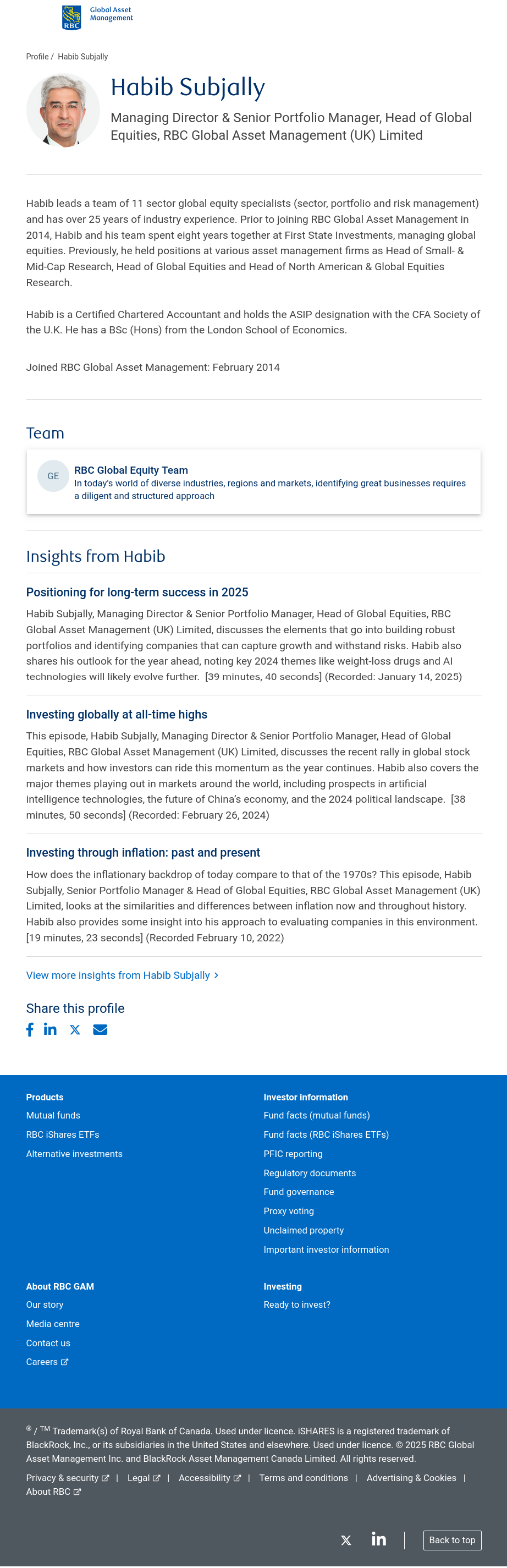

My fund is managed by that guy. I sold everything. Will reinvest in Europe.

How should you invest?

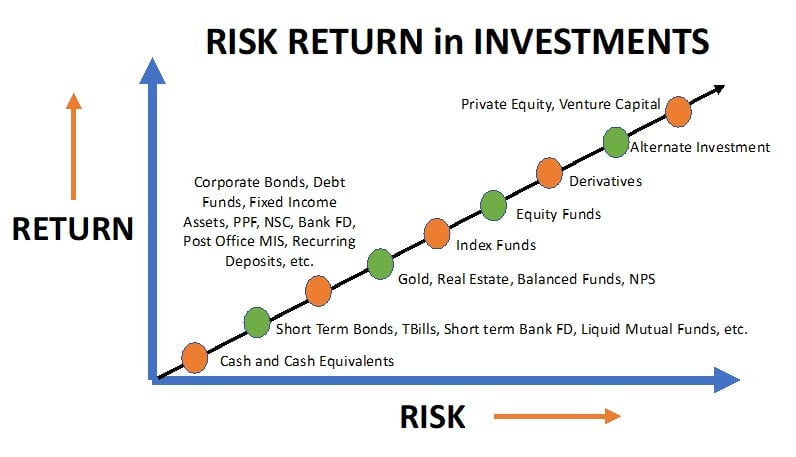

Profit comes with risk.

high risk, high reward (on average)

Don’t take more risk than you can carry. For example, if you’ll surely need at least 100% of your money back in a few years, don’t put all of that money into stock (shares), because they are unpredictable in the short term.

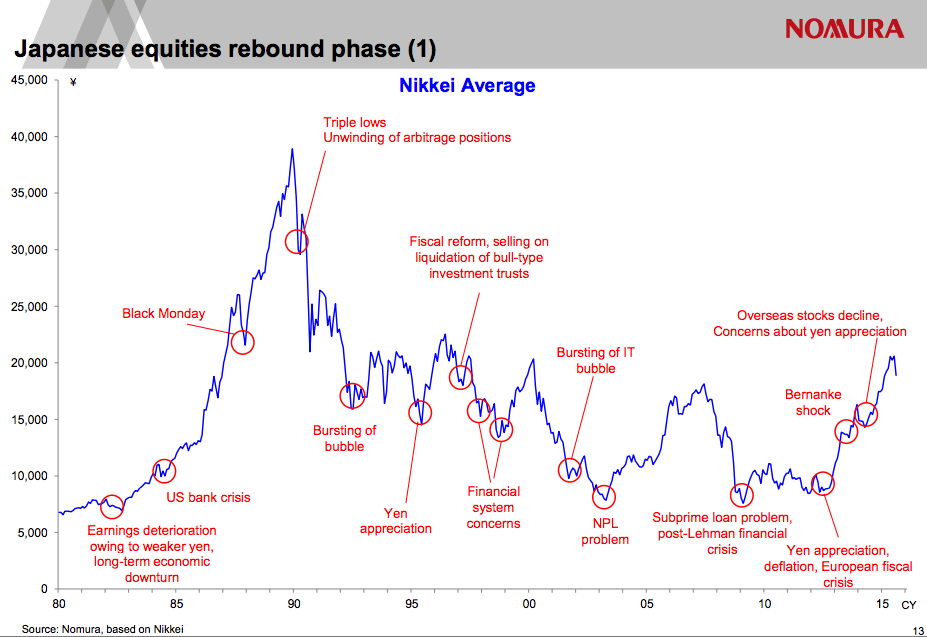

In the stock market, even the duration of a “short term” is unpredictable. For example, if you invested in Japan right before the 1980s bubble burst, you would have had to wait 20 years to recover from the crash.

Japan bubble peak 1990

Owning your house is an undiversified, unhedged investment in real estate. What if there’s a bubble about to burst? What if the house is hit by a disaster that insurance won’t cover? If I owned a house, I’d probably take some debt and buy foreign shares not related to house prices.

Easiest way to invest safely:

Hire a fiduciary to craft a passive (cheap) investment strategy suited to your needs. My bank offers free advice for crafting a strategy.

(Don’t buy actively managed funds with costly fees - it’s a waste of money, except in a few special cases. The bank will happily sell you an expensive service.)

Easy way to invest somewhat ethically:

Put your money into ESG-compliant or highly EU SFDR-rated index funds (with really cheap fees) that don’t invest in countries, industries, and companies you disapprove of.

(In some cases, switching between funds in the same bank allows you to avoid paying taxes from your previous winnings in the fund you want to get rid of, because the sell/buy -action is interpreted as an internal move.)

More ethical easy way to invest:

If the “responsible” ESG-labeled funds are too lax for your thirst for good, find a tailored fund / bespoke portfolio where you can set tighter criteria for ethical behaviour.

Do it yourself the right way:

Buy shares of companies you approve of - the most ethical companies trying to stay clean in a dirty economy. Makers of wind turbines, solar panels, batteries, cable, bicycles, electric vehicles (trains and trams!), sustainable forestry, etc.

It’s easy nowadays through many banks’ websites. Upkeep cost can be minimal.

A lazy strategy:

Store your money in various low risk financial instruments.

Once in every ~5 years, invest part of your savings in a diversified portfolio of 30 companies (and other high risk financial instruments) in at least 10 countries on at least 2 continents in at least 3 unrelated industries, and forget for 5 years.

Be sure to diversify in time by buying at different times to avoid accidentally investing everything on top of a global bubble.

If you’re feeling extra active, maybe prefer to buy in a depression and sell on a bubble, but you can’t predict the future any better than all the other investors trying to outsmart you. Price/earnings ratio measures investor optimism that bubbles are made of.

Between investment sprees, save into a regular savings account.

Types of risk relevant in diversification and hedging:

If all your investments are subject to the same type of risk, they could crash at the same time.

Avoid participating in disaster capitalism with a moral hazard where companies doing disaster recovery cause disasters to pump up their share value.

If you think a company isn’t enriched by you buying previously issued, pre-owned, existing shares from someone else on the market, you’re wrong, because the company sees the increased demand on the market and issues more shares, making more money from investors after you. Same as when you buy a stolen item, the thief reacts to increased demand by stealing another one.

If you think donating to charities is more ethical than investing, I somewhat disagree: it’s good, but it’s also unsustainable. You can grow more charity power by growing money in benefit corporations that are effectively profit-seeking charities. Example: Mozilla.

I think crypto money is a waste of computation that could be used for something productive, like protein folding. That said, Wikipedia: Proof of stake # Energy consumption:

In 2021, a study by the University of London found that in general the energy consumption of the proof-of-work based Bitcoin was about a thousand times higher than that of the highest consuming proof-of-stake system … Ethereum’s switch to proof-of-stake was estimated to have cut its energy use by 99%.

(This post was originally in You Should Know. It was justly deleted for pushing an agenda, which is banned there. Thanks for all the comments that led me to write the above investment guide.)