This post was inspired by a combination of my ignorance regarding the geopolitical implications of currency exchange, a desire to understand what BRICS is and how it works, and comments in this post making fun of Paul Krugman. (https://hexbear.net/post/1040996)

In the comments to the linked post, comrades @emizeko@hexbear.net and @quarrk@hexbear.net discuss an article with an embedded video where economist Michael Hudson rips into some of Krugman’s work. (https://www.nakedcapitalism.com/2023/05/ny-times-is-wrong-on-dedollarization-economist-michael-hudson-debunks-paul-krugmans-dollar-defense.html)

It’s funny, but what I’m really interested in is an idea that Hudson presented. If I understand him correctly he states the following:

If countries conduct trade using American dollars, they have to first acquire these dollars by providing the US treasury with their own currency. This also requires establishing an American bank account. The US then uses that foreign currency to finance military bases/activities in places that require that currency.

The implications, as I understand them, are that you now have an American bank account holding at least some of your assets, and it’s vulnerable to being seized by the US government. It also means that a byproduct of using dollars is that the US acquires the means to pay leases, bribes, contractors, etc. to facilitate military dominance all over the globe. Thus, many nations desire to increase their security by moving away from the dollar.

Comrades, help me out. Is this correct? What other basic things are there to know? Is this really why dollar dominance is so important?

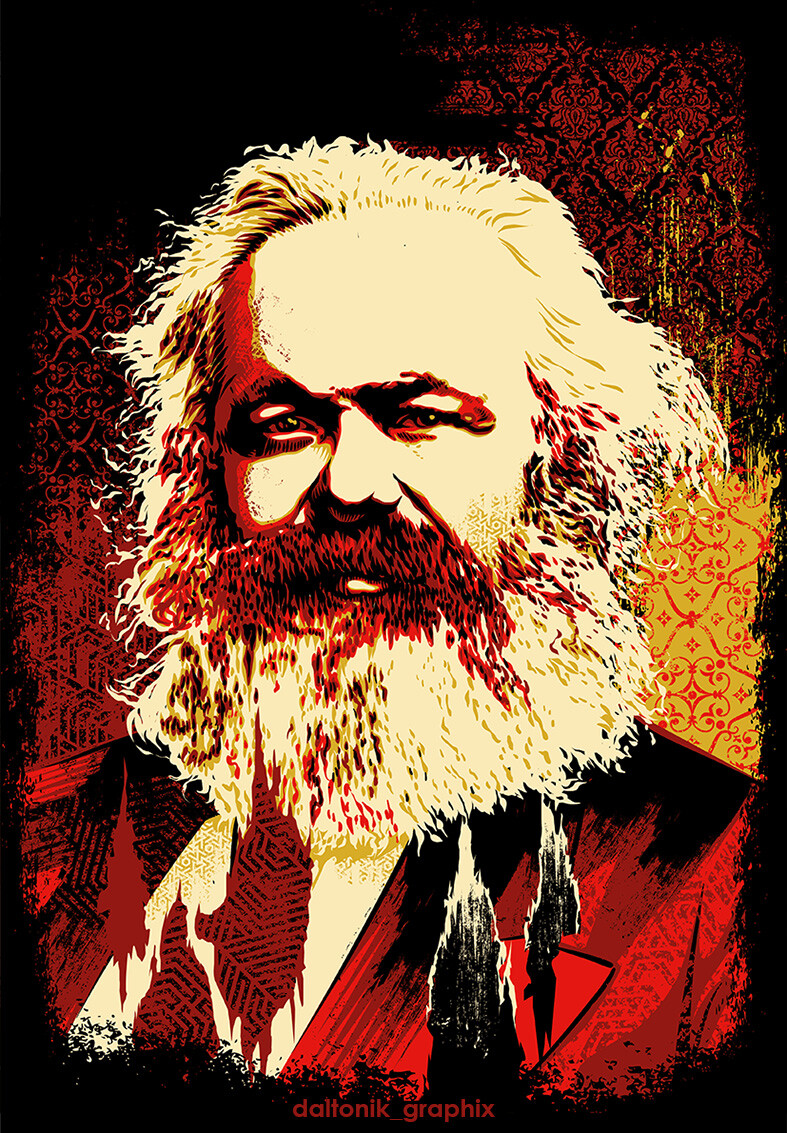

My dude, thank you. I actually didn’t know what reserve currency was, so even just explaining that was huge. The time value of money and risk (as an economic idea) is something I do understand pretty well, so the need for a stable reserve currency makes a lot of sense. I’ll have to do some reading. My list isn’t that long, but I don’t have enough time. I need to get through some more Marx first. Sleep well.