- cross-posted to:

- unions@lemmy.ml

- cross-posted to:

- unions@lemmy.ml

Boss gets a dollar, I get…less then a penny??? Aw hell!! Screw pooping on company time! I’mma just bring a gun into work!

…and the news has another days worth of content.

(Just to be clear, I’m NOT threatening to bring a gun to work. I don’t own a gun. I’m just showing how these scenarios play out)

You forgot to add “in Minecraft” there at the end, the police is on their way

It is weird to me that shootings are usually like hating on race or queerness, and never like “I’m going to shoot up the board of directors that cut my health insurance” or whatever. I guess the right wing hate machine is effective.

There’s only so much pooping I can do in eight hours. Would it be ok if I just sleep on the couch and drink coffee all day?

I’m just showing how these scenarios play out

But that’s not how office violence generally happens, it usually happens because someone is fired and gets really mad about it. You’re unlikely to bring a gun to work if you’re merely unemployed or underpaid.

Historically*

Am I the only one who thinks a non-founding CEO should never be allowed (let’s say by law) to get a raise simply due to how big their compensation package already is when they get hired?

What do they need more for? Invest that shit in the company or the other workers, and make CEOs job hop for raises like the rest of us have been doing for years. Except when they leave, they are explicitly barred from rehire at that company or any directly related to it. (Imagine this happens, and all of a sudden you have a wave of CEOs pushing for breaking up huge umbrella companies so they can maintain their grift… lol)

If they job hop every year, well that sure would make it obvious how pathetically little they actually do, wouldn’t it? When a series of “the next person” steps into the role and literally nothing changes ever.

Exactly. If you’re not a founder, you’re an employee, and you’ll need to earn your keep.

I think CEOs should be paid almost exclusively in stock, but that stock should also be taxed as regular income. If you’re regularly hopping, you won’t have enough time to get a meaningful amount of stock, so your income would be fairly low.

Stock — at least, RSUs — is AFAIK taxed like supplemental income ( https://www.harnesswealth.com/articles/what-you-need-to-know-about-restricted-stock-units-rsus/ ), which is very similar to regular income. Stock options are different though, and maybe this is what you’re referring to — I think (???) options can be beneficial to the recipient from a tax perspective vs. other compensation but not an expert…

And then there are capital gains, which is a different, but related, story…

Huh, I thought there was something like RSUs that were delayed compensation, but that’s apparently wrong. Looking into it, it looks like they don’t really avoid taxation on the actual compensation (either they’re taxed on vesting for RSUs, or taxed on the option spread), and one of the main benefits is delayed taxation/rolling options if the value drops.

So the main loophole seems to be inheritance taxes, which is unrelated to compensation, but does fuel the trend of borrowing instead of selling assets. If the estate was taxed for all unrealized capital gains before inheritance, I think we’d see a lot higher income tax bills from execs because it would essentially eliminate the “borrow/buy/die” loophole. We could take it one step further and require immediate taxation anytime stock changes hands (so even charitable giving would trigger capital gains tax).

That law will never be passed because the government is owned by corporations but if it did pass they would create a loophole. If the loophole was closed then the corporation would move to a more tax friendly country.

An executive action could change things because it can be effected immediately and penalize moving assets out of the country but you’d have to make it count because the cat is out of the bag at that point.

A CEOs salary is often just a small part of the compensation.

During some tech bubble bursts, many CEOs parade around saying they’ll only pay themselves a “dollar” for salary. What they aren’t telling you is their millions of stock options they’ll earn.

What they aren’t telling you is their millions of stock options they’ll earn.

Non-taxable, too.

Well, tax-deferred, since you don’t pay tax until you sell. And if it’s inherited, you get a free step-up in bases, so your kids won’t pay the tax either.

And I think Kamala Harris really screwed the pooch on this one. She ranted about taxing unrealized capital gains, which is going to tick off pretty much all the billionaires (and therefore their monetary support would move to her opponent), whereas if she just said she’d tax stock grants for people in executive positions (or over a certain income), they probably wouldn’t be as pissed because they’re largely founders, and thus there’s no stock grant to be taxed (it would mostly hit non-founder C-suites). In practice, this would just mean tax basis is stepped up at the time stocks vest, provided you’re above a certain income.

36% doesn’t tell a clean story. How many dozens of percentage raise would workers get if that CEO’s raise was evenly distributed?

Here’s what I came up with.

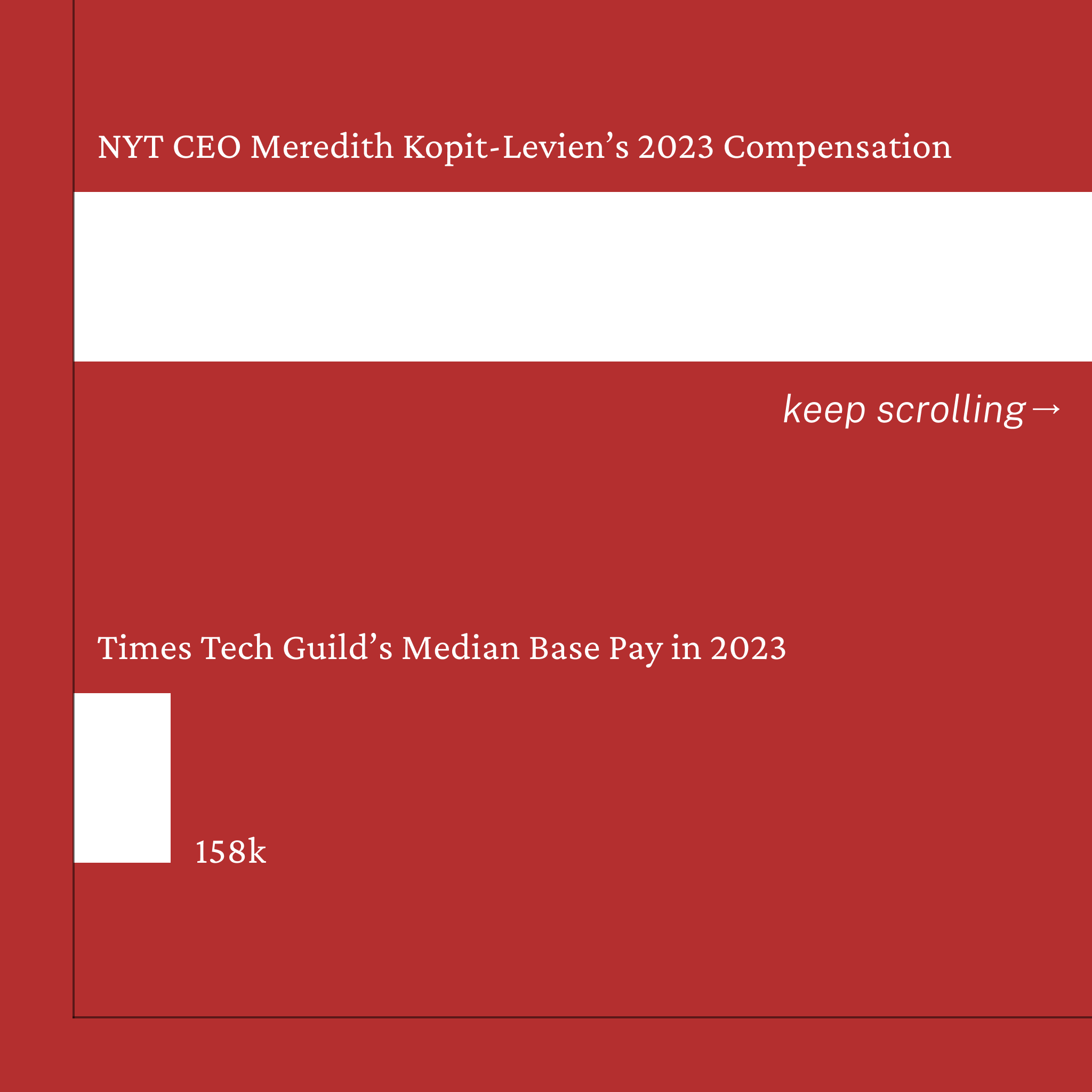

Using Meredith Kopit-Levien’s annual pay from the New York Times, at $10.2 million (as stated in the graph.) Then pluging in the 36% raise she was ‘given’ in 2024(?) and divide by 600 Times Tech Guild members. The following is what I got.

Base salary: $10.2 million 36% of $10.2 million = $10.2 million × 0.36 = $3.672 million $3.672 million ÷ 600 = $6,120 per person

Current average salary: $158,000 (using what was stated in the graph) Potential raise: $6,120 Percentage increase = ($6,120 ÷ $158,000) × 100 = 3.87%

So if the value of the 36% raise ($3.672 million) were distributed equally among the 600 guild members: Each member would receive a $6,120 raise This would represent approximately a 3.87% increase to their current average salary.

Or, to put it another way, at baseline, the CEO does the work of 64 people (10.2m/158k). And after raises, the CEO does the work of 85 people (13.9m/163k).

Wow, what a real bootstrapper. I stand in awe.

I mean there certainly are some CEOs that do sound like 85 assholes whenever they open their mouth. Elon Musk comes to mind as a good public example.

So they could have doubled everyone’s wage increase with that amount.

I see this possibly as this scenario perhaps. boss went 3 for you, 3 for me, 3 for you, 3 for me, 3 for you, 3 for me…

Does it matter?

That depends on your values. If your values say quantifying how much workers stand to gain if they shut down exorbitant C-suite wages, then good for you.

In most cases decreasing the CEO wage increase to increase workers would only increase workers wages by a tiny amount. That’s almost never the point. The point is that giving the CEO a bigger raise than the workers is a mockery of who actually produces anything.

Reverse that and you got yourself a banger.

To be fair, this should compare Tech Guild median total compensation, NOT base salary.